What Is the 940 Form?

Form 940 is used to report the yearly Federal Unemployment Tax Act (FUTA) tax to the government. As per the FUTA tax act, a certain amount is collected as tax from employers of the nation every year and sent to the funds that are used to support the nation’s unemployed workers.

Often, the delay of the payment of the FUTA tax results in penalties and interests. So, it is mandatory that the applicable employers must pay the tax before it is due and fully file the 940 forms without any errors.

Details Included in Form 940

Form 940 includes various details about the applicant as well as the tax return being filed. Some of the information included in the form are as follows:

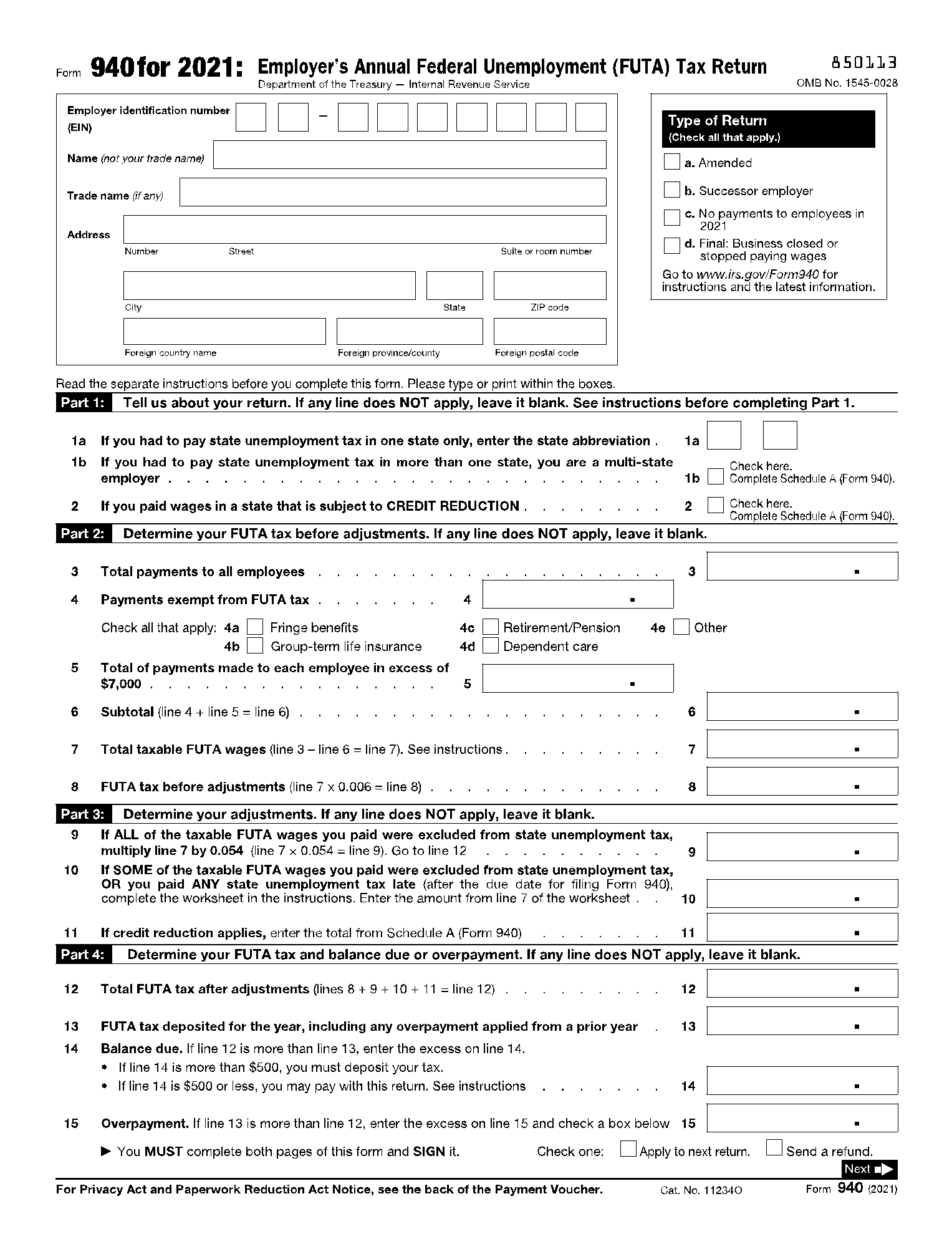

- Employer details - Employer Identification Number (EIN), name of the applicant, trade name, and address details.

- Return type - Check the type of return you are filing. Say if it is amended, successor employer, the business closed or no payment done to employees.

- State details - How many and what state do you pay unemployment tax, whether the state considers unemployment tax for credit reduction.

- FUTA tax before adjustments - Calculate your FUTA tax by using the payments to your employees, those payments that are exempt from FUTA, payments above $7000, and so on. You also need to calculate the FUTA tax in the way mentioned in the form if all of your payments come under the exemption.

- FUTA tax after adjustment and overpayment - Indicate the FUTA tax after the adjustment, payment due from the previous year, and overpayments details.

- FUTA tax liability - Give details of FUTA tax liability for all four quarters separately and the total for the year.

- Third-party designee - Indicate if you are giving consent to allow the IRS to speak with your employee or any other person about the tax return and their contact details.

- Signature - Your full name is needed along with your signature.

- Paid preparer details - This section includes information about the paid preparer of this tax return like name, PTIN, EIN, firm name, contact details, and so on, which are to be filled and signed by the paid preparer themself.

- Form 940 V: Payment voucher - This section includes the payment voucher which needs to be filled with the payment information and attached with the form.

How to Fill the Form 940?

Form 940 is one of the most significant legal documents that is used to file FUTA tax returns for employers. So, it is important to be very careful while filling the 940 form PDF, as any deliberate mistakes in the form may result in taking legal actions against you. The below guidelines can help you fill the form easily online.

Step 1- Download CocoDoc's free 940 form PDF available on this page.

Step 2 - You can use the CocoDoc online PDF editor to fill the form online and share it with the concerned people.

Step 3 - Use the text box sections to fill the text and number fields. Make sure you fill in the right EIN and other crucial details.

Step 4 - To check the options for certain questions with checkboxes, just click on the appropriate checkbox and the option will be highlighted.

Step 5 - Fill the form 940-V, the payment voucher carefully with the right payment information.

Step 6 - Sign the document using CocoDoc's digital signing feature and share it or save it for further processing.

Who Needs to File the Form 940?

Form 940 must be filed by the employers who have paid more than a certain amount of wages to their employees in a given financial year as said by the government. It applies to almost all employers including:

- Household employers have employees for their private home, local college club, or a local chapter of a college fraternity.

- Agricultural employers

The following employers are exempt from the FUTA tax and need not file form 940.

- Federally recognized Indian tribal governments who are part of the state unemployment system for a whole year.

- Certain religious, charitable, educational, and other organizations are exempt from FUTA tax.

- State and local government employers who use the services of the government employees.

Form 940 must be filed within the due date by the concerned employers in order to skip any penalties or interest costs. Upon filing form 940, the employer must settle their FUTA tax on time. This tax is sent to the federal unemployment funds which are used for unemployed workers who have lost their jobs for certain reasons.